There is a full list of nondeductible expenses in Publication 529, Miscellaneous Deductions PDF.

Taxpayers should know there are nondeductible expenses.

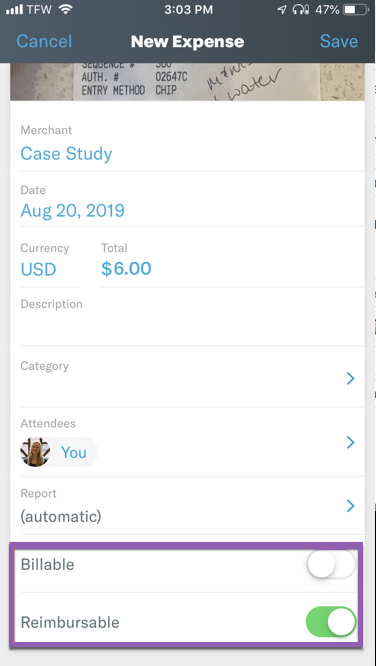

Not only is it important as a business owner to confirm that every expense is valid, receipts are non-negotiable if you are audited by the Canada Revenue Agency (CRA). Non-Reimbursable Expenses means costs and expenses of Operator that are not to be funded or reimbursed by MSC (whether as Costs of Operations or otherwise) nor. Employees with impairment-related work expenses Yes Never reimburse expenses without a receipt.Fee-basis state or local government officials.If someone falls into one of these employment categories, they are considered a qualified employee: That will include covering gas, oil, insurance costs, repairs, fees for registration and deprecation or lease. If an organization wishes to offer a vehicle reimbursement program, the IRS requires companies to cover certain expenses before considering the program non-taxable. They must complete Form 2106, Employee Business Expenses, to take the deduction. Car-related expenses make up a major aspect of IRS Publication 463. reimbursable '+ : not reimbursable Love words You must there are over 200,000 words in our free online dictionary, but you are looking for one that’s only in the Merriam-Webster Unabridged Dictionary. Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions, unless they are a qualified employee or an eligible educator. Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators.

0 kommentar(er)

0 kommentar(er)